import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

import pandas_datareader as pdr

import datetime as dt

import statsmodels.formula.api as smf

import statsmodels.api as sm

from statsmodels.graphics.tsaplots import plot_acf

from statsmodels.graphics.tsaplots import pacf as pacf_func

from statsmodels.graphics.tsaplots import acf as acf_func

import statsmodels.graphics.tsaplots as tsa

from statsmodels.graphics.tsaplots import plot_pacf

from statsmodels.tsa.arima_process import ArmaProcess

from statsmodels.tsa.arima.model import ARIMA

plt.style.use("ggplot")

import plotly.graph_objects as go

import os

from dotenv import load_dotenv

from statsmodels.tsa.stattools import adfullerload_dotenv()

fred_api_key = os.getenv("FRED_API_KEY")

from fredapi import Fred

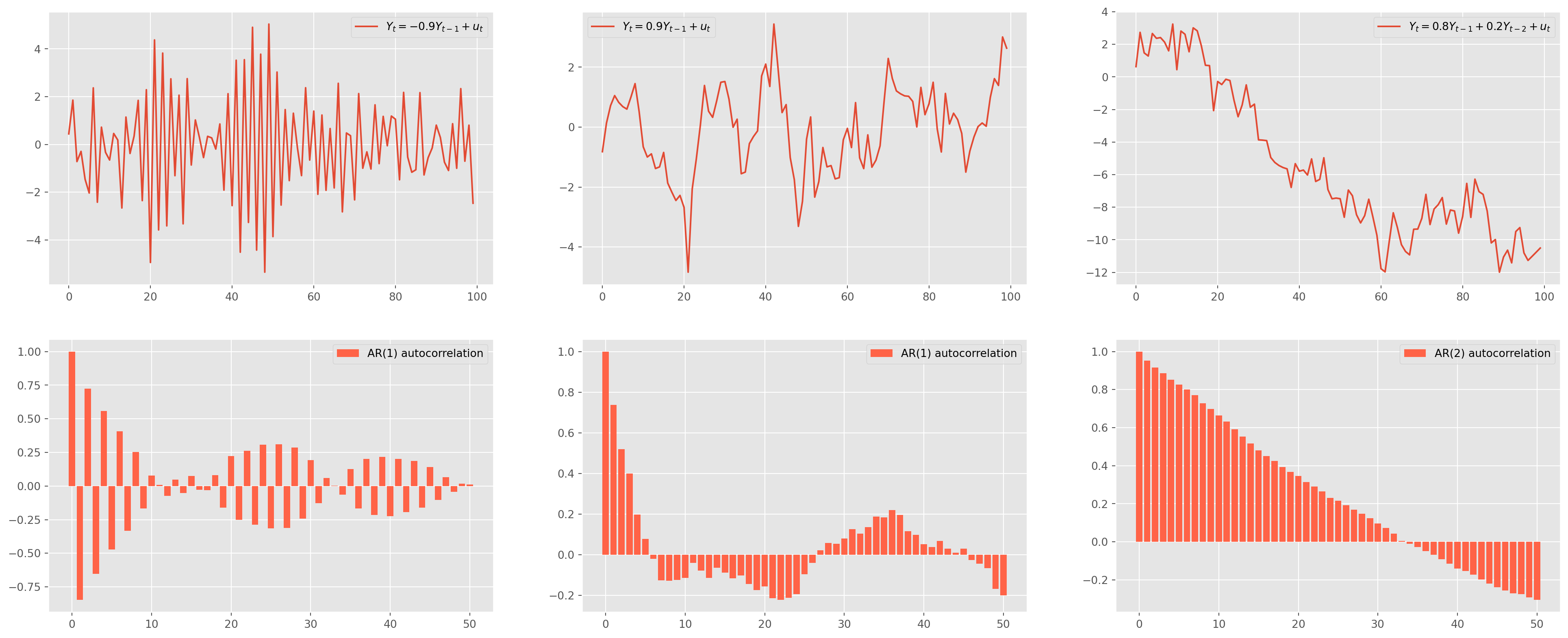

fred = Fred(api_key=fred_api_key)We have introduced \(\text{AR}\) and \(\text{MA}\) models in previous chapters, in this chapter we will discuss the practical issues of both models. \[

\text{AR(1)}: \qquad Y_{t}=\phi_0+\phi_{1} Y_{t-1}+u_{t}

\] If \(\phi<0\), the time series exhibits mean-reversion feature, if \(\phi>0\) exhibits trend-following feature. One reminder, ArmaProcess needs zero lag coefficient \(1\) to be input explicitly and the sign from lag \(1\) onward must be sign-reversed.

ar_params = np.array([1, 0.9])

ma_params = np.array([1])

ar1 = ArmaProcess(ar_params, ma_params)

ar1_sim = ar1.generate_sample(nsample=100)

ar1_sim = pd.DataFrame(ar1_sim, columns=["AR(1)"])

ar1_acf = acf_func(ar1_sim.values, fft=False, nlags=50)

ar_params1 = np.array([1, -0.9])

ma_params1 = np.array([1])

ar1_pos = ArmaProcess(ar_params1, ma_params1)

ar1_sim_pos = ar1_pos.generate_sample(nsample=100)

ar1_sim_pos = pd.DataFrame(ar1_sim_pos, columns=["AR(1)"])

ar1_acf_pos = acf_func(ar1_sim_pos.values, fft=False, nlags=50)

ar_params2 = np.array([1, -0.8, -0.2])

ma_params2 = np.array([1])

ar2 = ArmaProcess(ar_params2, ma_params2)

ar2_sim = ar2.generate_sample(nsample=100)

ar2_sim = pd.DataFrame(ar2_sim, columns=["AR(2)"])

ar2_acf = acf_func(ar2_sim.values, fft=False, nlags=50)fig, ax = plt.subplots(figsize=(25, 10), nrows=2, ncols=3)

ax[0, 0].plot(ar1_sim, label="$Y_t = {%s}Y_{t-1}+u_t$" % (-ar_params[1]))

ax[0, 0].legend()

ax[1, 0].bar(

np.arange(len(ar1_acf)), ar1_acf, color="tomato", label="AR(1) autocorrelation"

)

ax[1, 0].legend()

ax[0, 1].plot(ar1_sim_pos, label="$Y_t = {%s}Y_{t-1}+u_t$" % (-ar_params1[1]))

ax[0, 1].legend()

ax[1, 1].bar(

np.arange(len(ar1_acf_pos)),

ar1_acf_pos,

color="tomato",

label="AR(1) autocorrelation",

)

ax[1, 1].legend()

ax[0, 2].plot(

ar2_sim,

label="$Y_t = {%s} Y_{t-1}+{%s} Y_{t-2}+u_t$" % (-ar_params2[1], -ar_params2[2]),

)

ax[0, 2].legend()

ax[1, 2].bar(

np.arange(len(ar2_acf)), ar2_acf, color="tomato", label="AR(2) autocorrelation"

)

ax[1, 2].legend()

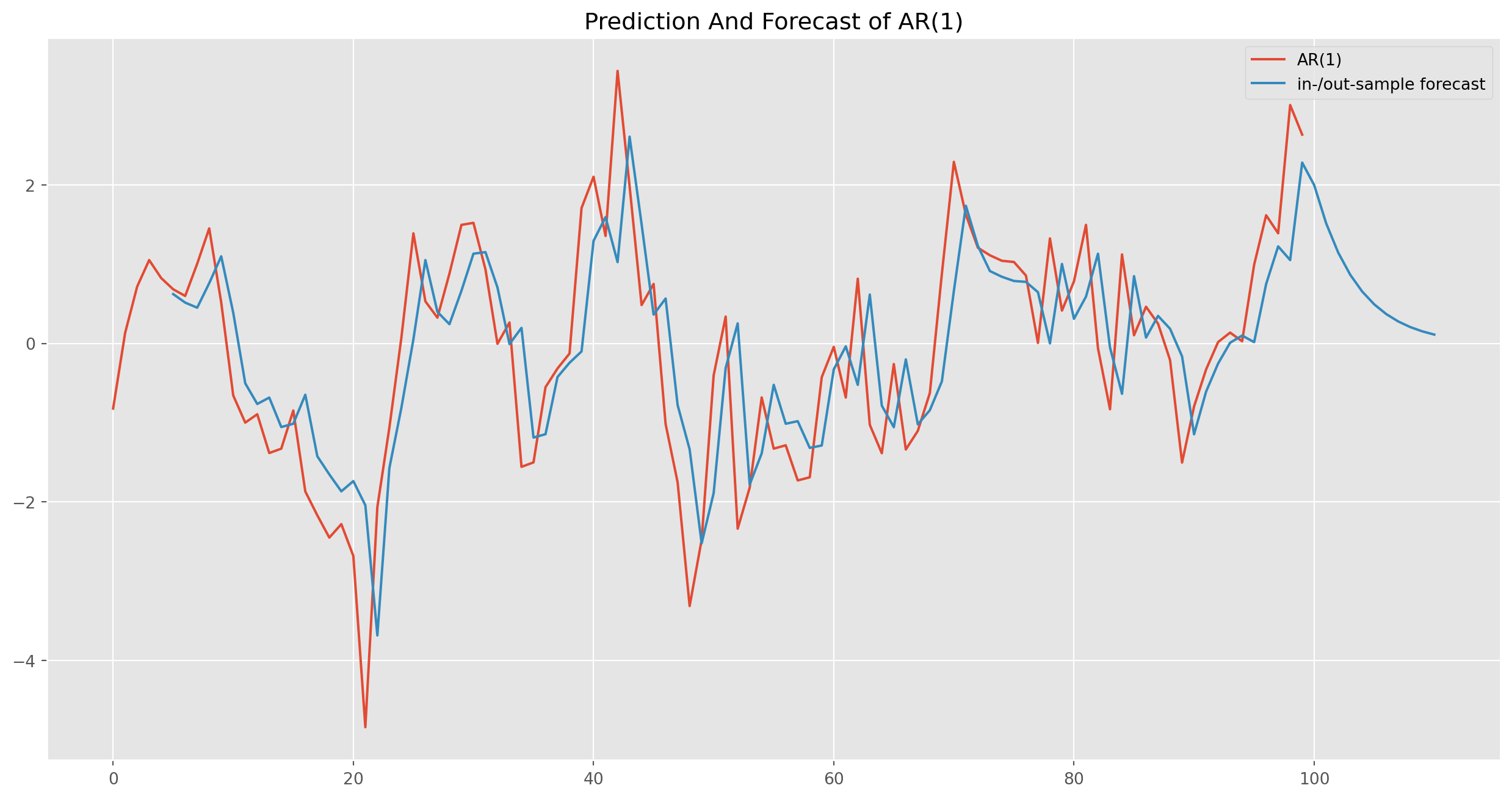

plt.show()Estimation and Forecast of AR

Output sigma2 is the variance of residuals.

mod_obj = ARIMA(ar1_sim_pos, order=(1, 0, 0))

result = mod_obj.fit()

print(result.summary()) SARIMAX Results

==============================================================================

Dep. Variable: AR(1) No. Observations: 100

Model: ARIMA(1, 0, 0) Log Likelihood -135.561

Date: Sun, 27 Oct 2024 AIC 277.122

Time: 17:33:50 BIC 284.937

Sample: 0 HQIC 280.285

- 100

Covariance Type: opg

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

const -0.0176 0.394 -0.045 0.964 -0.790 0.755

ar.L1 0.7600 0.062 12.197 0.000 0.638 0.882

sigma2 0.8735 0.114 7.629 0.000 0.649 1.098

===================================================================================

Ljung-Box (L1) (Q): 0.10 Jarque-Bera (JB): 1.91

Prob(Q): 0.75 Prob(JB): 0.39

Heteroskedasticity (H): 0.93 Skew: -0.21

Prob(H) (two-sided): 0.84 Kurtosis: 3.53

===================================================================================

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).res_predict = result.predict(start=5, end=110)Identification of the Order of an AR Model

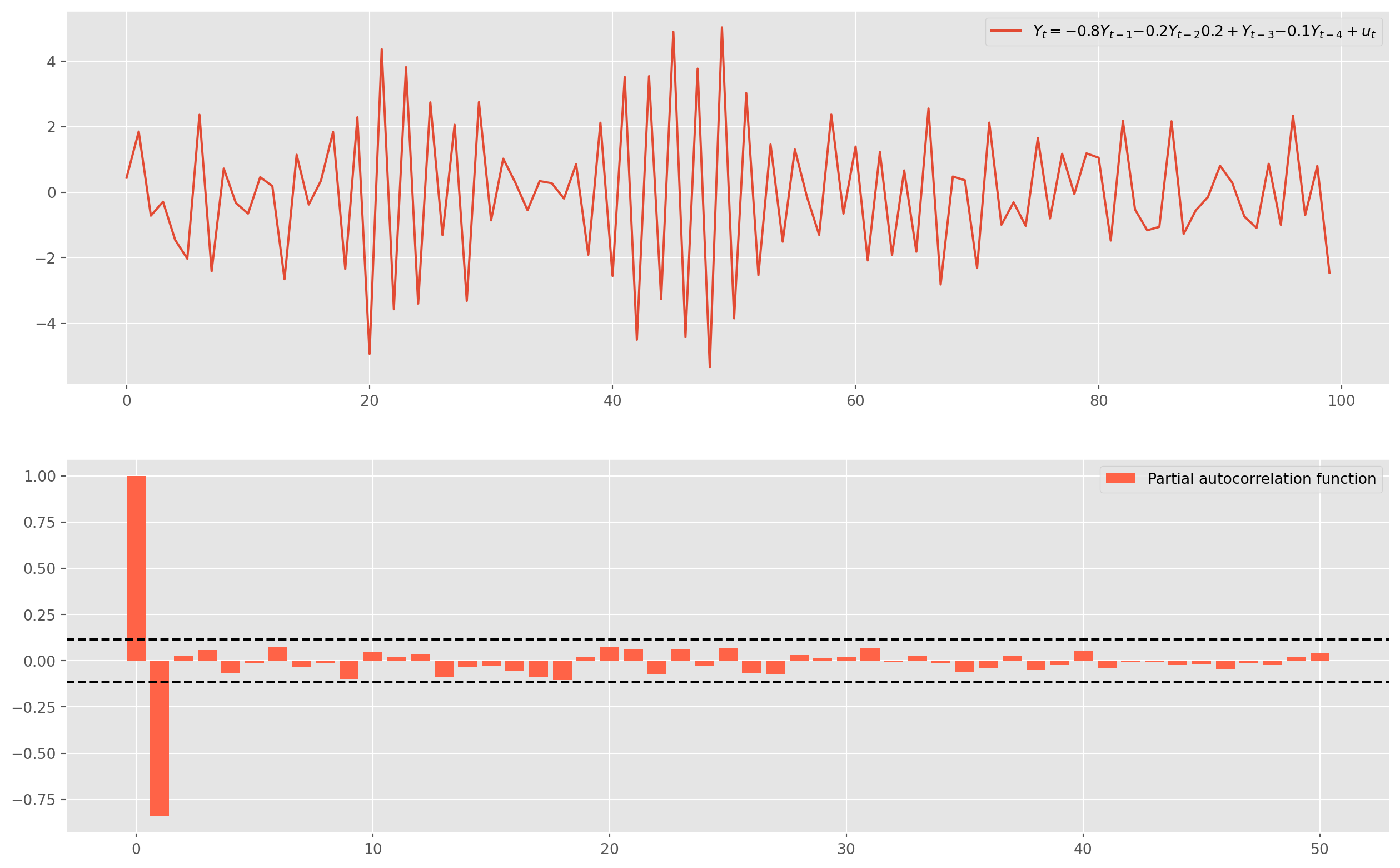

The usual practice of order identification is called the Box-Jenkins Methodology, which will be explicated below, for now we simply perform two techniques: 1. Partial Autocorrelation Function 2. Akaike or Bayesian Information Criteria (\(\text{AIC}\), \(\text{BIC}\))|

obs = 300

ar_params = np.array([1, 0.8, 0.2, -0.2, 0.1])

ma_params = np.array([1])

ar4 = ArmaProcess(ar_params, ma_params)

ar4_sim = ar1.generate_sample(nsample=obs)

ar4_sim = pd.DataFrame(ar4_sim, columns=["AR(4)"])

ar4_pacf = pacf_func(ar4_sim.values, nlags=50)

fig, ax = plt.subplots(figsize=(16, 10), nrows=2, ncols=1)

ax[0].plot(

ar1_sim,

label="$Y_t = {%s}Y_{t-1} {%s}Y_{t-2} {%s}+Y_{t-3} {%s}Y_{t-4}+u_t$"

% (-ar_params[1], -ar_params[2], -ar_params[3], -ar_params[4]),

)

ax[0].legend()

ax[1].bar(

np.arange(len(ar4_pacf)),

ar4_pacf,

color="tomato",

label="Partial autocorrelation function",

)

ax[1].axhline(y=2 / np.sqrt(obs), linestyle="--", color="k")

ax[1].axhline(y=-2 / np.sqrt(obs), linestyle="--", color="k")

ax[1].legend()

plt.show()Only lag \(1\) is significant, we could estimate it with \(\text{AR(1)}\), the better idea is to loop the estimation to plot the \(\text{AIC}\) and \(\text{BIC}\).

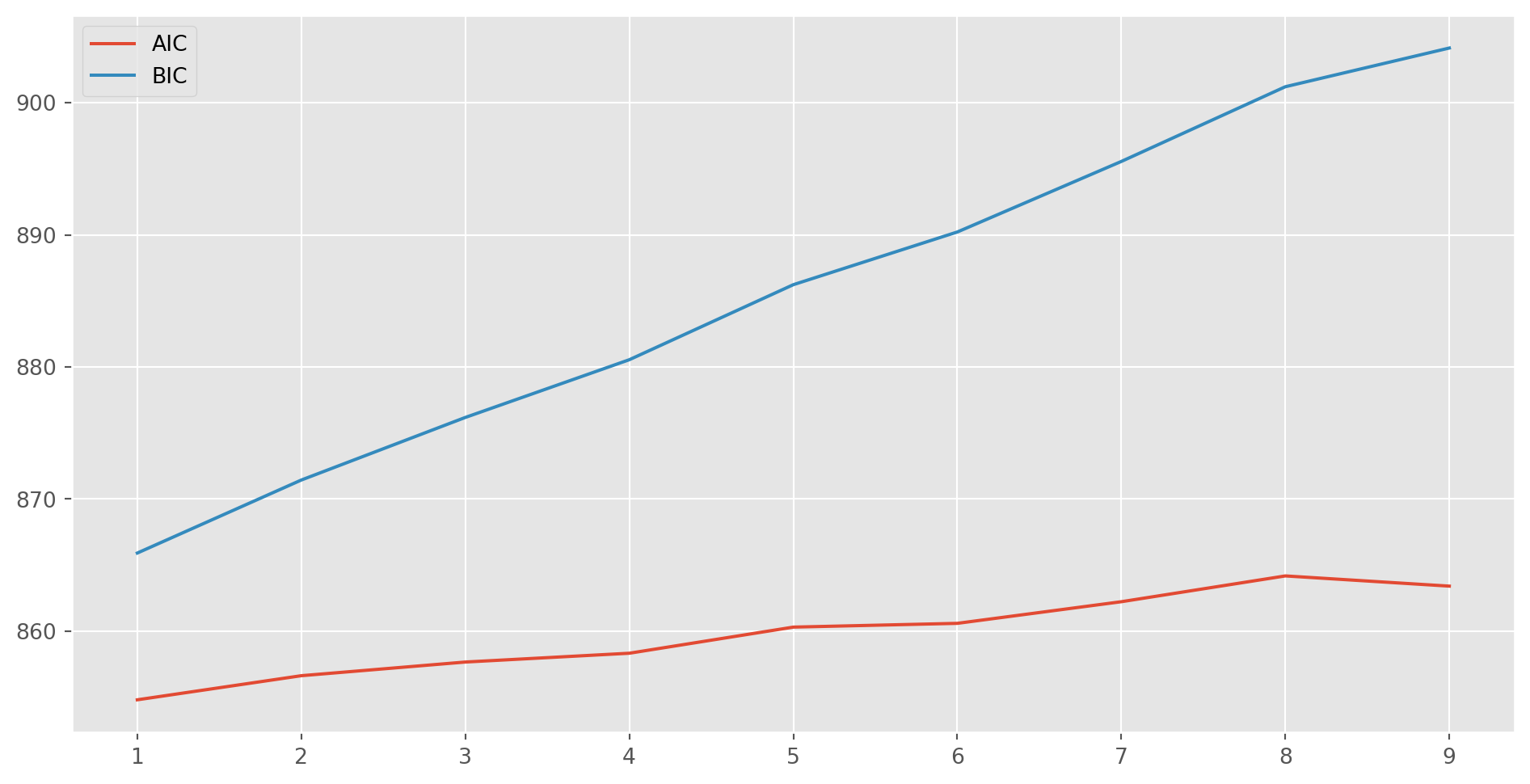

aic, bic = [], []

for i in range(10):

mod_obj = ARIMA(ar4_sim, order=(i, 0, 0))

result = mod_obj.fit()

aic.append(result.aic)

bic.append(result.bic)fig, ax = plt.subplots(figsize=(12, 6))

ax.plot(range(1, 10), aic[1:10], label="AIC")

ax.plot(range(1, 10), bic[1:10], label="BIC")

ax.legend()

plt.show()\(\text{BIC}\) is monotonically increasing, \(\text{AIC}\) reaches the lowest at the second lag, however we always choose the simpler model to fit, in this case an \(\text{AR(1)}\) model.

mod_obj = ARIMA(ar4_sim, order=(1, 0, 0))

result = mod_obj.fit()

print(result.summary()) SARIMAX Results

==============================================================================

Dep. Variable: AR(4) No. Observations: 300

Model: ARIMA(1, 0, 0) Log Likelihood -424.402

Date: Sun, 27 Oct 2024 AIC 854.804

Time: 17:33:53 BIC 865.915

Sample: 0 HQIC 859.250

- 300

Covariance Type: opg

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

const -0.0453 0.032 -1.438 0.150 -0.107 0.016

ar.L1 -0.8312 0.030 -28.028 0.000 -0.889 -0.773

sigma2 0.9876 0.086 11.476 0.000 0.819 1.156

===================================================================================

Ljung-Box (L1) (Q): 0.09 Jarque-Bera (JB): 1.43

Prob(Q): 0.76 Prob(JB): 0.49

Heteroskedasticity (H): 0.73 Skew: 0.13

Prob(H) (two-sided): 0.12 Kurtosis: 2.77

===================================================================================

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).Meta Trader 5 Data

If you have a MetaTrader 5 account, install the MetaTrader5 library, then run the codes below to login the account.

import MetaTrader5 as mt5

login = 123456

password = 'abcdefgh'

server = 'XXXXXXX-Demo'

mt5.initialize()

mt5.login(login, password, server)Then you can retrieve high frequency data from your broker’s server, for instance here we retrieve one minute candlesticks data of \(\text{USDJPY}\). start_bar means the current bar, num_bars is the number of bars all before the current bar.

symbol = 'USDJPY'

timeframe = 1

start_bar = 0

num_bars = 5000

bars = mt5.copy_rates_from_pos(symbol, timeframe, start_bar, num_bars)Because the time column is present in Unix timestamp, some conversion has to be done as below

kbars = pd.DataFrame(bars)

time =[]

for i in range(len(kbars['time'])):

time.append(dt.datetime.fromtimestamp(kbars['time'][i]))

kbars['time'] = timeIf you need it for later research, save it as a .csv file

kbars.to_csv('../dataset/USDJPY_1m.csv', index=False)I have uploaded this dataset onto repository.

usdjpy = pd.read_csv("../dataset/USDJPY_1m.csv")fig = go.Figure(

data=[

go.Candlestick(

x=usdjpy["time"],

open=usdjpy["open"],

high=usdjpy["high"],

low=usdjpy["low"],

close=usdjpy["close"],

)

]

)

fig.update_layout(

xaxis_rangeslider_visible=False, autosize=False, width=1100, height=700

)

fig.show()MA Model

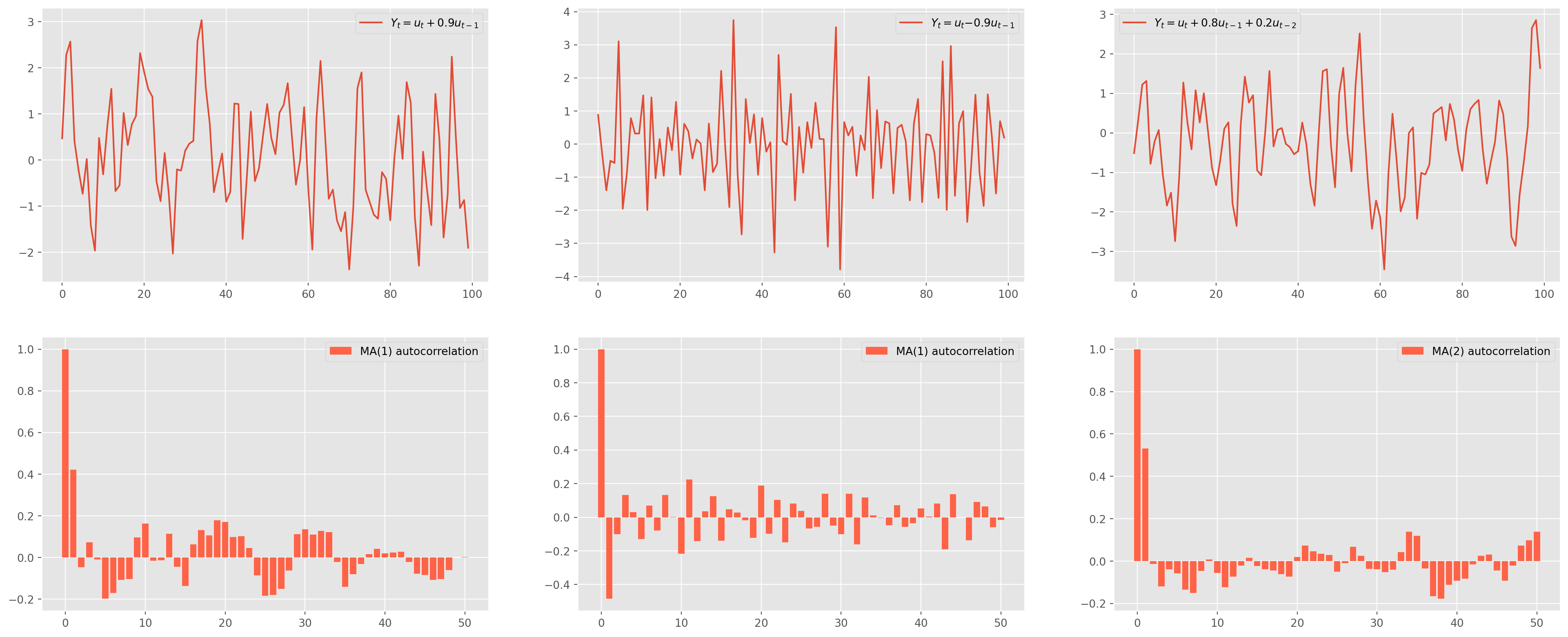

Here is an \(\text{MA(1)}\) model \[ Y_{t}= u_{t}+\theta_{1} u_{t-1} \]

ar_params = np.array([1])

ma_params = np.array([1, 0.9])

ma1 = ArmaProcess(ar_params, ma_params)

ma1_sim = ma1.generate_sample(nsample=100)

ma1_sim = pd.DataFrame(ma1_sim, columns=["MA(1)"])

ma1_acf = acf_func(ma1_sim.values, fft=False, nlags=50)

ar_params1 = np.array([1])

ma_params1 = np.array([1, -0.9])

ma1_neg = ArmaProcess(ar_params1, ma_params1)

ma1_sim_neg = ma1_neg.generate_sample(nsample=100)

ma1_sim_neg = pd.DataFrame(ma1_sim_neg, columns=["MA(1)"])

ma1_acf_neg = acf_func(ma1_sim_neg.values, fft=False, nlags=50)

ar_params2 = np.array([1])

ma_params2 = np.array([1, 0.8, 0.2])

ma2 = ArmaProcess(ar_params2, ma_params2)

ma2_sim = ma2.generate_sample(nsample=100)

ma2_sim = pd.DataFrame(ma2_sim, columns=["MA(2)"])

ma2_acf = acf_func(ma2_sim.values, fft=False, nlags=50)fig, ax = plt.subplots(figsize=(25, 10), nrows=2, ncols=3)

ax[0, 0].plot(ma1_sim, label="$Y_t = u_t + {%s} u_{t-1}$" % (ma_params[1]))

ax[0, 0].legend()

ax[1, 0].bar(

np.arange(len(ma1_acf)), ma1_acf, color="tomato", label="MA(1) autocorrelation"

)

ax[1, 0].legend()

ax[0, 1].plot(ma1_sim_neg, label="$Y_t = u_t {%s} u_{t-1}$" % (ma_params1[1]))

ax[0, 1].legend()

ax[1, 1].bar(

np.arange(len(ma1_acf_neg)),

ma1_acf_neg,

color="tomato",

label="MA(1) autocorrelation",

)

ax[1, 1].legend()

ax[0, 2].plot(

ma2_sim,

label="$Y_t = u_t +{%s} u_{t-1}+ {%s} u_{t-2} $"

% (ma_params2[1], ma_params2[2]),

)

ax[0, 2].legend()

ax[1, 2].bar(

np.arange(len(ma2_acf)), ma2_acf, color="tomato", label="MA(2) autocorrelation"

)

ax[1, 2].legend()

plt.show()Estimation and Forecast of MA

mod_obj = ARIMA(ma1_sim_neg, order=(0, 0, 1))

result = mod_obj.fit()

print(result.summary()) SARIMAX Results

==============================================================================

Dep. Variable: MA(1) No. Observations: 100

Model: ARIMA(0, 0, 1) Log Likelihood -145.923

Date: Sun, 27 Oct 2024 AIC 297.846

Time: 17:33:54 BIC 305.662

Sample: 0 HQIC 301.009

- 100

Covariance Type: opg

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

const -0.0061 0.008 -0.729 0.466 -0.022 0.010

ma.L1 -0.9427 0.052 -18.035 0.000 -1.045 -0.840

sigma2 1.0604 0.158 6.704 0.000 0.750 1.370

===================================================================================

Ljung-Box (L1) (Q): 0.01 Jarque-Bera (JB): 0.11

Prob(Q): 0.93 Prob(JB): 0.95

Heteroskedasticity (H): 1.33 Skew: -0.03

Prob(H) (two-sided): 0.42 Kurtosis: 2.85

===================================================================================

Warnings:

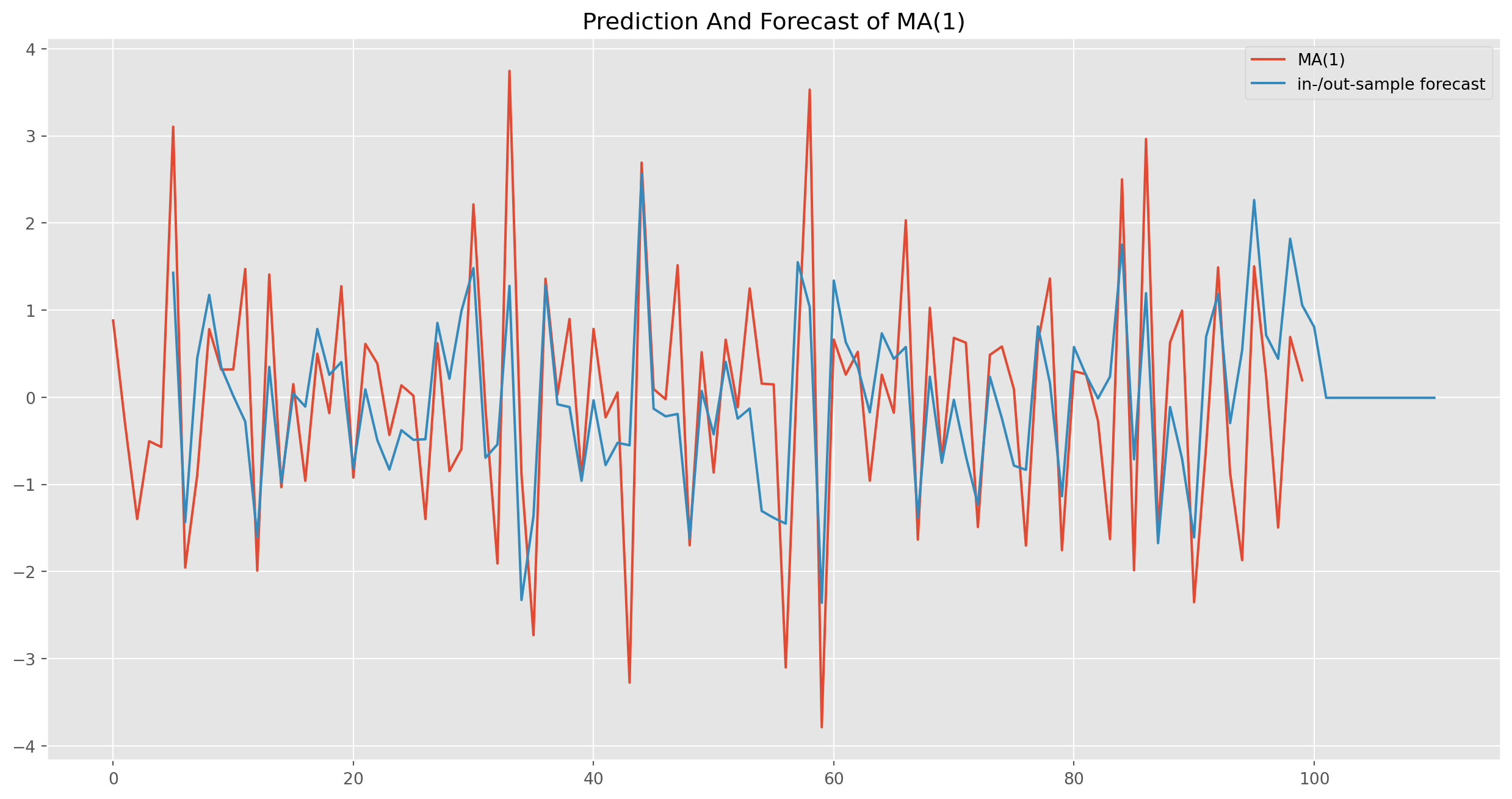

[1] Covariance matrix calculated using the outer product of gradients (complex-step).res_predict = result.predict(start=5, end=110)ma1_sim_neg.plot(figsize=(16, 8))

res_predict.plot(

label="in-/out-sample forecast", title="Prediction And Forecast of MA(1)"

)

plt.legend()

plt.show()Note that all forecasts beyond one-step ahead forecast will all be the same, namely a straight line.

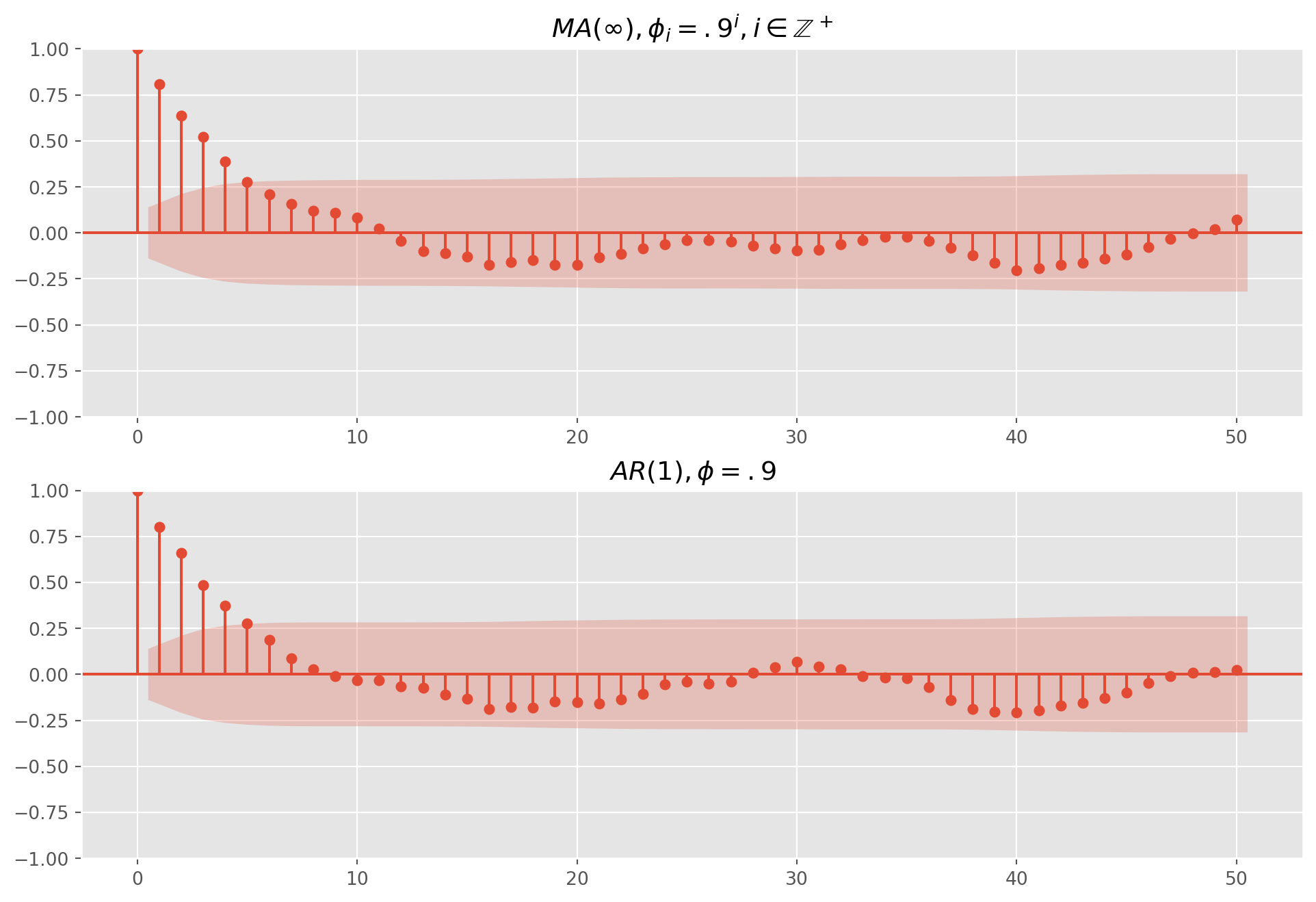

Connection of AR and MA

We can show any \(\text{AR(1)}\) can be rewritten as an \(\text{MA}(\)\()\) model \[ \text{AR(1)}: \qquad Y_{t}=\phi_0+\phi_{1} Y_{t-1}+u_{t} \] Perform a recursive substitution \[\begin{align} y_t &= \phi_0 + \phi_1(\phi_0 + \phi_1y_{t-2}+u_{t-1})+u_t = \phi_0 + \phi_1\phi_0+\phi_1^2y_{t-2}+\phi_1u_{t-1}+u_t\\ &= \phi_0 + \phi_1\phi_0+\phi_1^2(\phi_0+\phi_1y_{t-3}+u_{t-2})+\phi_1u_{t-1}+u_t=\phi_0 + \phi_1\phi_0 +\phi_1^2\phi_0 +\phi_1^3y_{t-3}+\phi_1^2u_{t-2}+\phi_1u_{t-1}+u_t\\ &\qquad\vdots\\ &=\frac{\phi_0}{1-\phi_1}+\sum_{i=0}^\infty\phi_1^iu_{t-1} \end{align}\] It holds because of the fact \[ \lim_{i\rightarrow\infty}\phi_1^iy_{t-i}=0 \]

fig, ax = plt.subplots(nrows=2, ncols=1, figsize=(12, 8))

ar = np.array([1])

ma = np.array([0.8**i for i in range(100)])

mod_obj = ArmaProcess(ar, ma)

ma_sim = mod_obj.generate_sample(nsample=200)

g = plot_acf(

ma_sim, ax=ax[0], lags=50, title=r"$MA(\infty), \phi_i = .9^i, i\in \mathbb{Z}^+$"

)

ar = np.array([1, -0.8])

ma = np.array([1])

mod_obj = ArmaProcess(ar, ma)

ar_sim = mod_obj.generate_sample(nsample=200)

g = plot_acf(ar_sim, ax=ax[1], lags=50, title=r"$AR(1), \phi=.9$")ARMA and ARIMA

Now we combine \(\text{AR}\) and \(\text{MA}\) models as \(\text{ARMA}\) and \(\text{ARMIA}\).

An \(\text{ARMA}(1,1)\) process is a combination of \(\text{AR}\) and \(\text{MA}\) \[ Y_{t}=\phi_0+\phi_{1} Y_{t-1}+\theta_{0} u_{t}+\theta_{1} u_{t-1} \]

In general, \(\text{ARMA}(p,q)\) process has the form \[ Y_t = \phi_0 + \phi_i\sum_{i=1}^pY_{t-i}+\sum_{i=1}^q\theta_i u_{t-i} \]

And \(\text{ARIMA}\) model is essentially the same as \(\text{ARMA}\), if we have to difference a series \(d\) times to render it stationary then apply the \(\text{ARIMA}\) model, we say that the original time series is \(\text{ARIMA}(p,d,q)\).

With the same token, \(\text{ARIMA}(p,0,q)\) process is the same as \(\text{ARMA}(p,q)\).

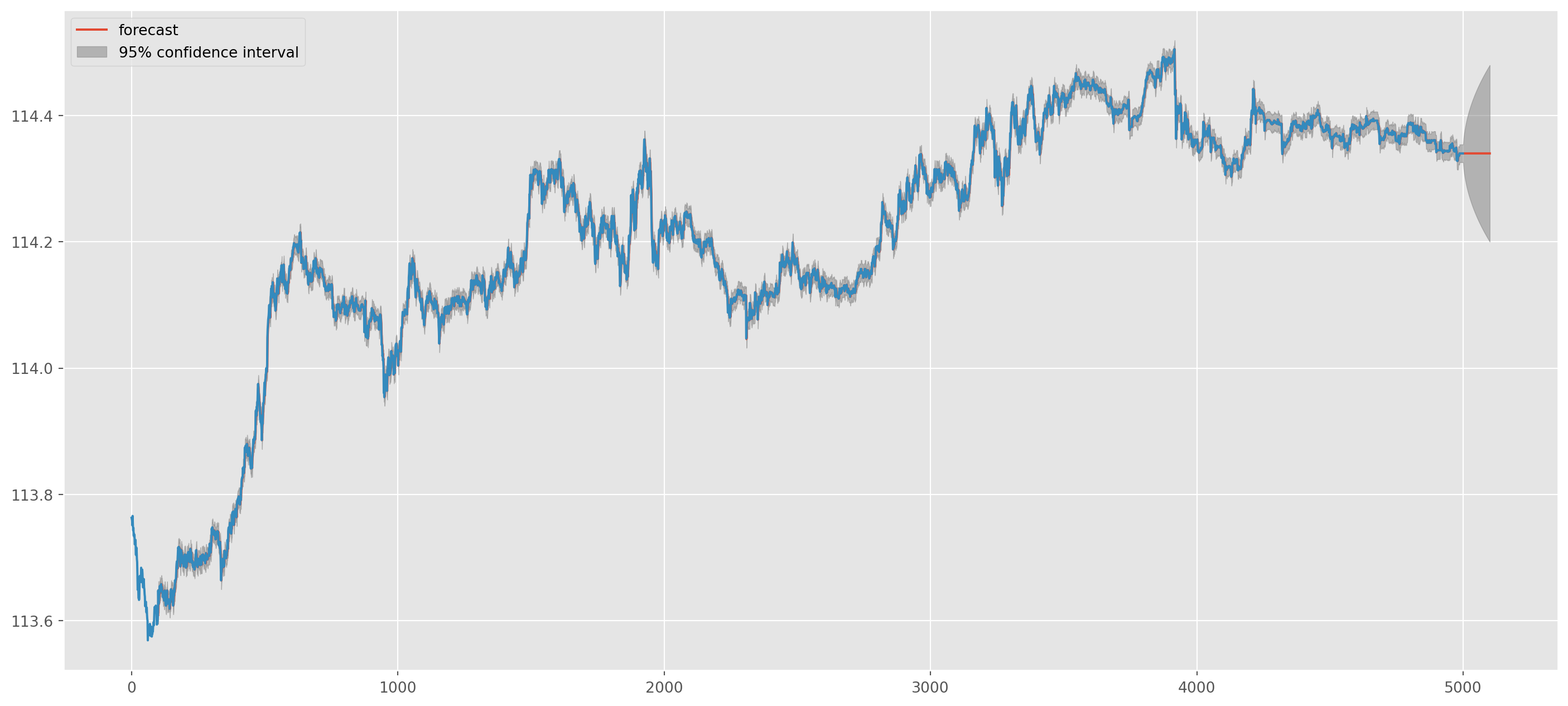

usdjpy = pd.read_csv("../dataset/USDJPY_1m.csv")usdjpy_close = usdjpy["close"].dropna()mod_obj = ARIMA(usdjpy_close, order=(2, 1, 2))results = mod_obj.fit()print(results.summary()) SARIMAX Results

==============================================================================

Dep. Variable: close No. Observations: 5000

Model: ARIMA(2, 1, 2) Log Likelihood 17568.668

Date: Sun, 27 Oct 2024 AIC -35127.336

Time: 17:33:56 BIC -35094.751

Sample: 0 HQIC -35115.915

- 5000

Covariance Type: opg

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

ar.L1 0.9867 0.553 1.785 0.074 -0.097 2.070

ar.L2 -0.2962 0.530 -0.559 0.576 -1.334 0.742

ma.L1 -0.9737 0.555 -1.753 0.080 -2.062 0.115

ma.L2 0.2785 0.533 0.522 0.601 -0.767 1.324

sigma2 5.18e-05 5.06e-07 102.362 0.000 5.08e-05 5.28e-05

===================================================================================

Ljung-Box (L1) (Q): 0.01 Jarque-Bera (JB): 8939.75

Prob(Q): 0.94 Prob(JB): 0.00

Heteroskedasticity (H): 0.48 Skew: -0.26

Prob(H) (two-sided): 0.00 Kurtosis: 9.53

===================================================================================

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).The Box-Jenkins Methodology

With so many options at hands, what model to apply to a time series? This is where Box-Jenkins Methodology kick in, which provides a systematic method of identifying, estimating and checking with \(\text{ARIMA}\) models.

ACF VS PACF

Before discussion of \(\text{ARIMA}\) identification, we should understand the difference of autocorrelation function (ACF) and partial autocorrelation function (PACF), which both are important tools for identifying lags of \(\text{ARIMA}\).

We have shown that the formula of sample ACF \[\begin{aligned} &\hat{\gamma}_{k}=\frac{\sum\left(Y_{t}-\bar{Y}\right)\left(Y_{t+k}-\bar{Y}\right)}{n-k} \\ &\hat{\gamma}_{0}=\frac{\sum\left(Y_{t}-\bar{Y}\right)^{2}}{n-1}\\ &\hat{\rho}_{k} =\frac{\hat{\gamma}_{k}}{\hat{\gamma}_{0}}=\frac{\text { covariance at lag } k}{\text { variance }} \end{aligned}\]However, PACF doesn’t have a formula. Simply speaking, PACF requires removing all correlations in between. e.g. if you are measuring variables \(k\) periods apart, then all influences from other variables in period \(<k\) should be eliminated.

Regression with demeaned variables can give us the partial autocorrelation, e.g. \[ y_t-\bar{y}=\phi_{21} (y_{t-1}-\bar{y})+\phi_{22} (y_{t-2}-\bar{y})+\phi_{33} (y_{t-3}-\bar{y})+u_{t} \] Estimates of \(\phi_{kk}\) is the partial correlation at lag \(3\).

So how to use ACF and PACF to identify the lags of \(\text{ARMA}\) model? First we transform the original data into log difference, then plot both correlograms.

start = dt.datetime(1980, 1, 1)

end = dt.datetime(2021, 10, 1)

df_cpi = pdr.data.DataReader(["CPIAUCSL"], "fred", start, end)

df_cpi.columns = ["urban_CPI"]

df_cpi = df_cpi.dropna()fig, ax = plt.subplots(nrows=2, ncols=1, figsize=(16, 8))

fig = plot_acf(

np.log(df_cpi).diff().dropna(),

ax=ax[0],

lags=100,

color="red",

zero=False,

title="ACF of Urban CPI",

)

fig = plot_pacf(

np.log(df_cpi).diff().dropna(),

ax=ax[1],

lags=100,

color="red",

zero=False,

title="PACF of Urban CPI",

method="ols",

)Simulation of ACF and PACF

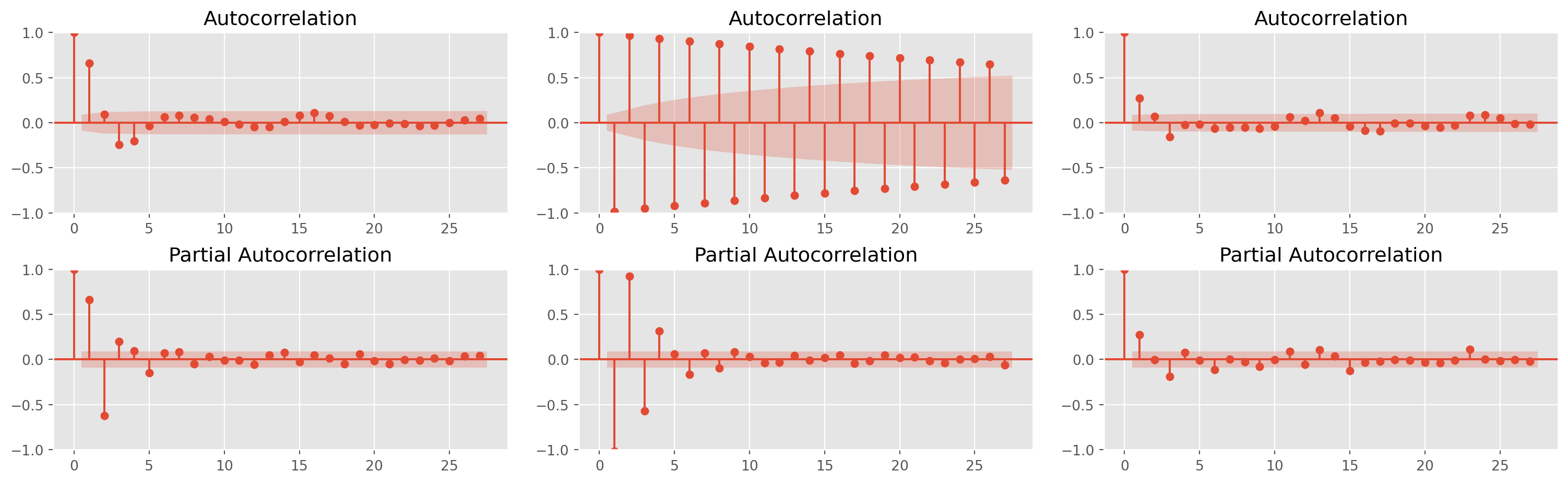

arparams = np.array([[0.63, -0.5], [-0.23, 0.8], [-0.5, -0.5]])

maparams = np.array([[0.58, 0.45], [0.78, 0.34], [0.8, 0.8]])

fig, ax = plt.subplots(nrows=2, ncols=3, figsize=(16, 5))

fig.tight_layout(pad=2.0)

ar = np.r_[1, -arparams[0]]

ma = np.r_[1, maparams[0]]

arma22 = ArmaProcess(ar, ma).generate_sample(nsample=500)

fig = plot_acf(arma22, ax=ax[0, 0])

fig = plot_pacf(arma22, ax=ax[1, 0], method="ols")

ar = np.r_[1, -arparams[1]]

ma = np.r_[1, maparams[1]]

arma22 = ArmaProcess(ar, ma).generate_sample(nsample=500)

fig = plot_acf(arma22, ax=ax[0, 1])

fig = plot_pacf(arma22, ax=ax[1, 1], method="ols")

ar = np.r_[1, -arparams[2]]

ma = np.r_[1, maparams[2]]

arma22 = ArmaProcess(ar, ma).generate_sample(nsample=500)

fig = plot_acf(arma22, ax=ax[0, 2])

fig = plot_pacf(arma22, ax=ax[1, 2], method="ols")How you set the parameters has to be consistent with lag operator form of \(\text{ARMA}\) model as below, which is the exact reason we set the opposite sign of \(\phi\)’s.

\[ \left(1-\phi_{1}L-\ldots-\phi_{p}L^{p}\right)y_{t} = \left(1+\theta_{1}L+\ldots+\theta_{q}L^{q}\right)\varepsilon_{t} \]

Identification of ARMA

The identification of \(\text{ARMA}\) doesn’t have clear-cut rules, but here are four guideline to help you decide the lags of \(\text{ARMA}\) model. 1. If PACF shows significant lags through \(p\) and ACF dampens exponentially, try \(\text{AR}(p)\) 2. If ACF shows significant lags through \(q\) and PACF dampens exponentially, try \(\text{MA}(q)\) 3. Both ACF and PACF dampen exponentially with significant lags \((p, q)\), try \(\text{ARMA}(p, q)\)

Vector Autoregression (VAR)

A Vector Autogression model has at least two variables, though it seems like a system of equations, every equation can be estimated by independently by OLS. This is viable because VAR model doesn’t differentiate endogenous or exogenous variables.

The general two variable \(\text{VAR(p)}\) model has the form \[\begin{align} Y_t &= \alpha_1 + \sum_{i=1}^p\beta_i Y_{t-i} +\sum_{i=1}^p\gamma_i X_{t-i}+u_{1t}\\ X_t &= \alpha_2 + \sum_{i=1}^p\eta_i X_{t-i} +\sum_{i=1}^p\theta_i Y_{t-i}+u_{2t} \end{align}\] where \(Y\) and \(X\) are variables, \(\alpha\)’s are constants, \(u_1\) and \(u_t\) are shocks in the context of VAR.

Note that VAR is a type atheortical model, unlike simultaneous-equation models, VAR doesn’t deal with model identification which is a good news for practitioners. However, it doesn’t mean you can add any variables into the model, if the variables have little connection with each other, the forecasting power is also severely undermined.

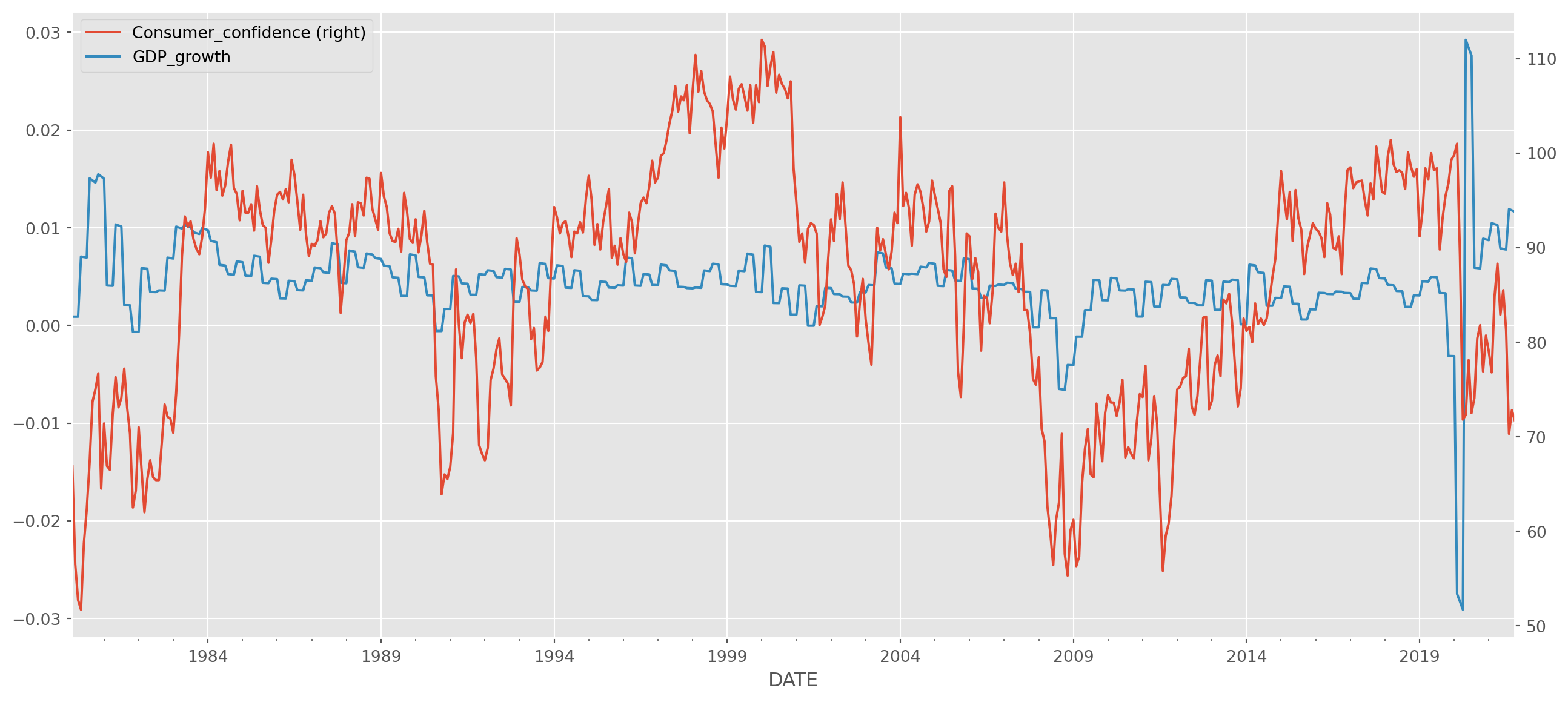

To illustrate estimation process, we import quarterly GDP and monthly consumer sentiment from FRED, however in order to take advantage of abundant monthly observation of consumer sentiment, quarterly GDP shall be resampled into monthly by linear interpolation.

start = dt.datetime(1980, 1, 1)

end = dt.datetime(2021, 10, 1)

df = pdr.data.DataReader(["GDP", "UMCSENT"], "fred", start=start, end=end)

df.dropna()

df.columns = ["GDP", "Consumer_confidence"]df["GDP"] = df["GDP"].resample("MS").interpolate(method="linear")

df.head()| GDP | Consumer_confidence | |

|---|---|---|

| DATE | ||

| 1980-01-01 | 2789.842000 | 67.0 |

| 1980-02-01 | 2792.345333 | 66.9 |

| 1980-03-01 | 2794.848667 | 56.5 |

| 1980-04-01 | 2797.352000 | 52.7 |

| 1980-05-01 | 2817.062333 | 51.7 |

Inspect the dataframe, we have quite abundant observations, \(504\) in total.

df.info()<class 'pandas.core.frame.DataFrame'>

DatetimeIndex: 502 entries, 1980-01-01 to 2021-10-01

Freq: MS

Data columns (total 2 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 GDP 502 non-null float64

1 Consumer_confidence 502 non-null float64

dtypes: float64(2)

memory usage: 11.8 KBPerform ADF test, keep in mind that \(H_0\) of Augmented Dicky-Fuller test is nonstationary. The results indicate that we only reject null hypothesis that consumer sentiment index is nonstationary, i.e. highly likely consumer sentiment is stationary.

results_dickeyfuller = adfuller(df["GDP"])

print("ADF Statistic of Quarterly GDP: %f" % results_dickeyfuller[0])

print("p-value: %f" % results_dickeyfuller[1])ADF Statistic of Quarterly GDP: 3.895097

p-value: 1.000000results_dickeyfuller = adfuller(df["Consumer_confidence"])

print("ADF Statistic of Consumer Sentiment: %f" % results_dickeyfuller[0])

print("p-value: %f" % results_dickeyfuller[1])ADF Statistic of Consumer Sentiment: -3.007303

p-value: 0.034218Change GDP level data into growth rate.

df["GDP_growth"] = df["GDP"].pct_change()

df = df.dropna()

df = df.drop(["GDP"], axis=1)Observe the moving pattern of both series.

Test stationarity of GDP growth rate.

results_dickeyfuller = adfuller(df["GDP_growth"])

print("ADF Statistic: %f" % results_dickeyfuller[0])

print("p-value: %f" % results_dickeyfuller[1])ADF Statistic: -4.643324

p-value: 0.000107The result indicates GDP growth rate is stationary. Then we instantiate a VAR object.

from statsmodels.tsa.api import VAR

var_model = VAR(df, freq="MS")Fit the model, order of lags is chosen based on \(\text{BIC}\) though both criteria will be calculated. The default maximum tested lags are \(12\) and I suggest no more than \(12\), the VAR parameters consumes degree of freedom fast!

Suppose you have a \(5\) variable with \(5\) lags VAR model, each equation has \(25+1=26\) parameters, in total \(26\times5=130\) parameters, that means your observations must way more than this number to function properly.

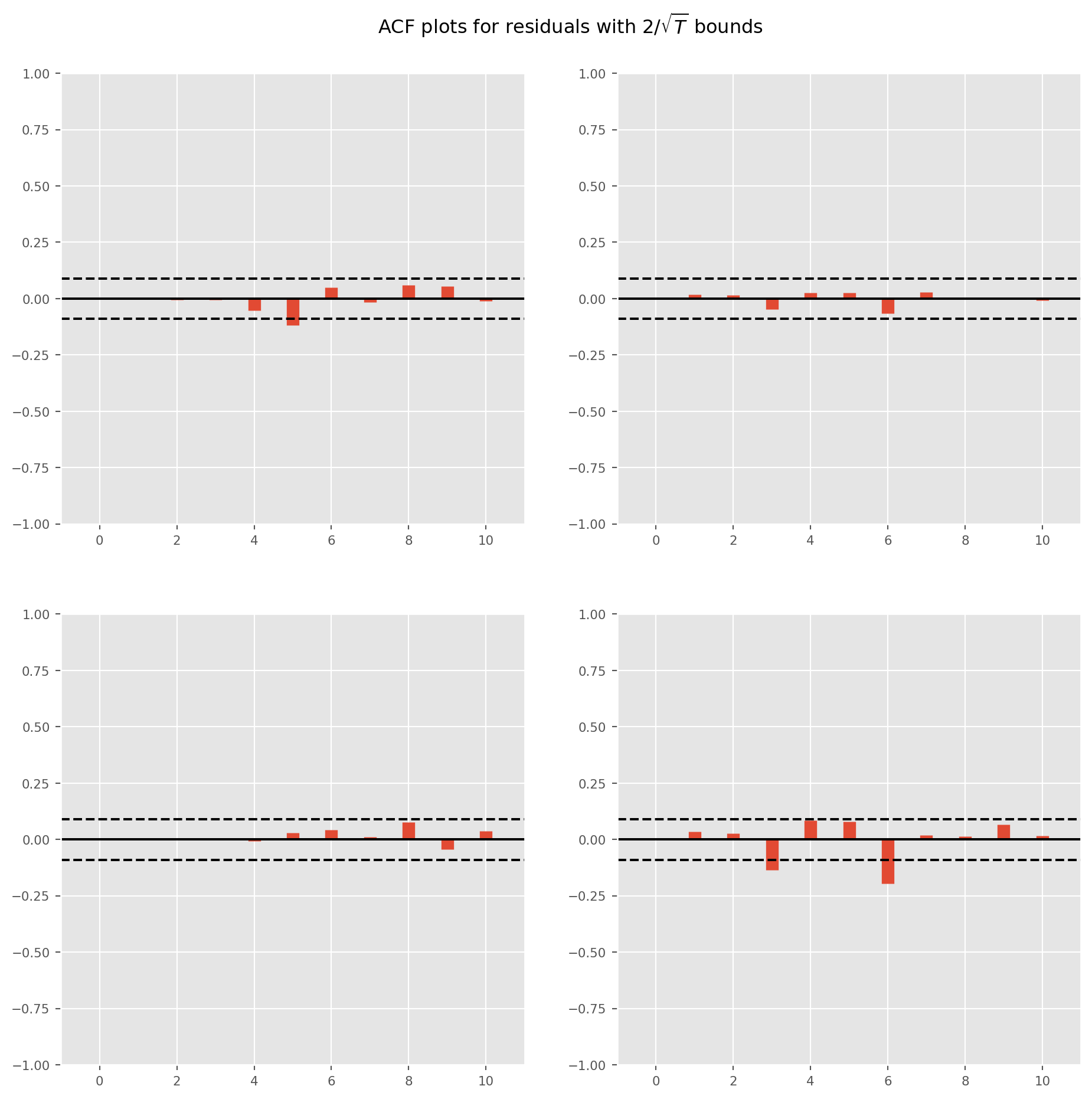

var_results = var_model.fit(verbose=True, ic="bic", method="ols")<statsmodels.tsa.vector_ar.var_model.LagOrderResults object. Selected orders are: AIC -> 7, BIC -> 4, FPE -> 7, HQIC -> 7>

Using 4 based on bic criterionPython streamlined the whole process, after choosing the appropriate lags, estimation can be promptly printed.

print(var_results.summary()) Summary of Regression Results

==================================

Model: VAR

Method: OLS

Date: Sun, 27, Oct, 2024

Time: 17:33:59

--------------------------------------------------------------------

No. of Equations: 2.00000 BIC: -8.91641

Nobs: 497.000 HQIC: -9.00901

Log likelihood: 861.180 FPE: 0.000115202

AIC: -9.06883 Det(Omega_mle): 0.000111140

--------------------------------------------------------------------

Results for equation Consumer_confidence

=========================================================================================

coefficient std. error t-stat prob

-----------------------------------------------------------------------------------------

const 4.305617 1.300126 3.312 0.001

L1.Consumer_confidence 0.909407 0.045334 20.060 0.000

L1.GDP_growth 180.953548 59.024168 3.066 0.002

L2.Consumer_confidence -0.069846 0.061510 -1.136 0.256

L2.GDP_growth -48.184341 73.110097 -0.659 0.510

L3.Consumer_confidence 0.052685 0.061688 0.854 0.393

L3.GDP_growth 50.747868 73.222484 0.693 0.488

L4.Consumer_confidence 0.047469 0.045004 1.055 0.292

L4.GDP_growth 41.208976 59.381271 0.694 0.488

=========================================================================================

Results for equation GDP_growth

=========================================================================================

coefficient std. error t-stat prob

-----------------------------------------------------------------------------------------

const 0.001972 0.000917 2.150 0.032

L1.Consumer_confidence -0.000071 0.000032 -2.229 0.026

L1.GDP_growth 0.855126 0.041647 20.533 0.000

L2.Consumer_confidence 0.000053 0.000043 1.222 0.222

L2.GDP_growth 0.008018 0.051586 0.155 0.876

L3.Consumer_confidence 0.000030 0.000044 0.678 0.497

L3.GDP_growth -0.521151 0.051665 -10.087 0.000

L4.Consumer_confidence -0.000021 0.000032 -0.648 0.517

L4.GDP_growth 0.395128 0.041899 9.431 0.000

=========================================================================================

Correlation matrix of residuals

Consumer_confidence GDP_growth

Consumer_confidence 1.000000 0.069515

GDP_growth 0.069515 1.000000

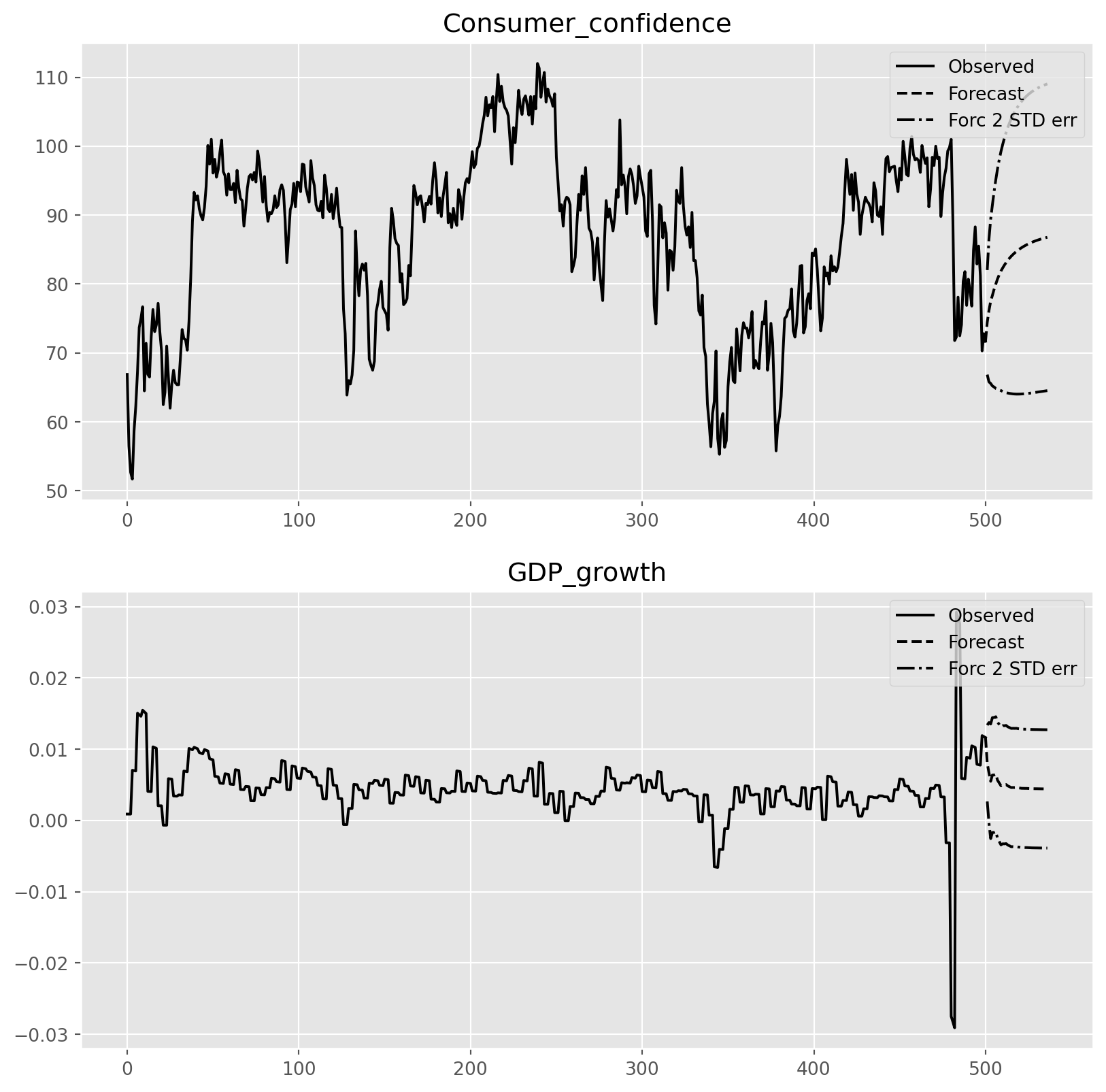

According to the results, the estimated VAR model is \[\begin{align} Y_t&= 0.001966 + 0.86 Y_{t-1} + 0.0058 Y_{t-2}-0.52 Y_{t-3}+0.39 Y_{t-4} -0.000061 S_{t-1} +0.000043 S_{t-2} + 0.00004 S_{t-3}-0.000031 S_{t-4}\\ S_t&= 4.336760 + 0.90 S_{t-1} -0.069 S_{t-2}+0.058 S_{t-3}+0.048 S_{t-4} +189.72 Y_{t-1} -39.39 Y_{t-2} + 40.49 Y_{t-3} + 44.57 Y_{t-4} \end{align}\]

lag_order = var_results.k_ar

var_results.forecast(df.values[-lag_order:], 5)array([[7.44467148e+01, 8.03263262e-03],

[7.61538714e+01, 6.70489792e-03],

[7.74959300e+01, 5.49665475e-03],

[7.83464400e+01, 6.37573858e-03],

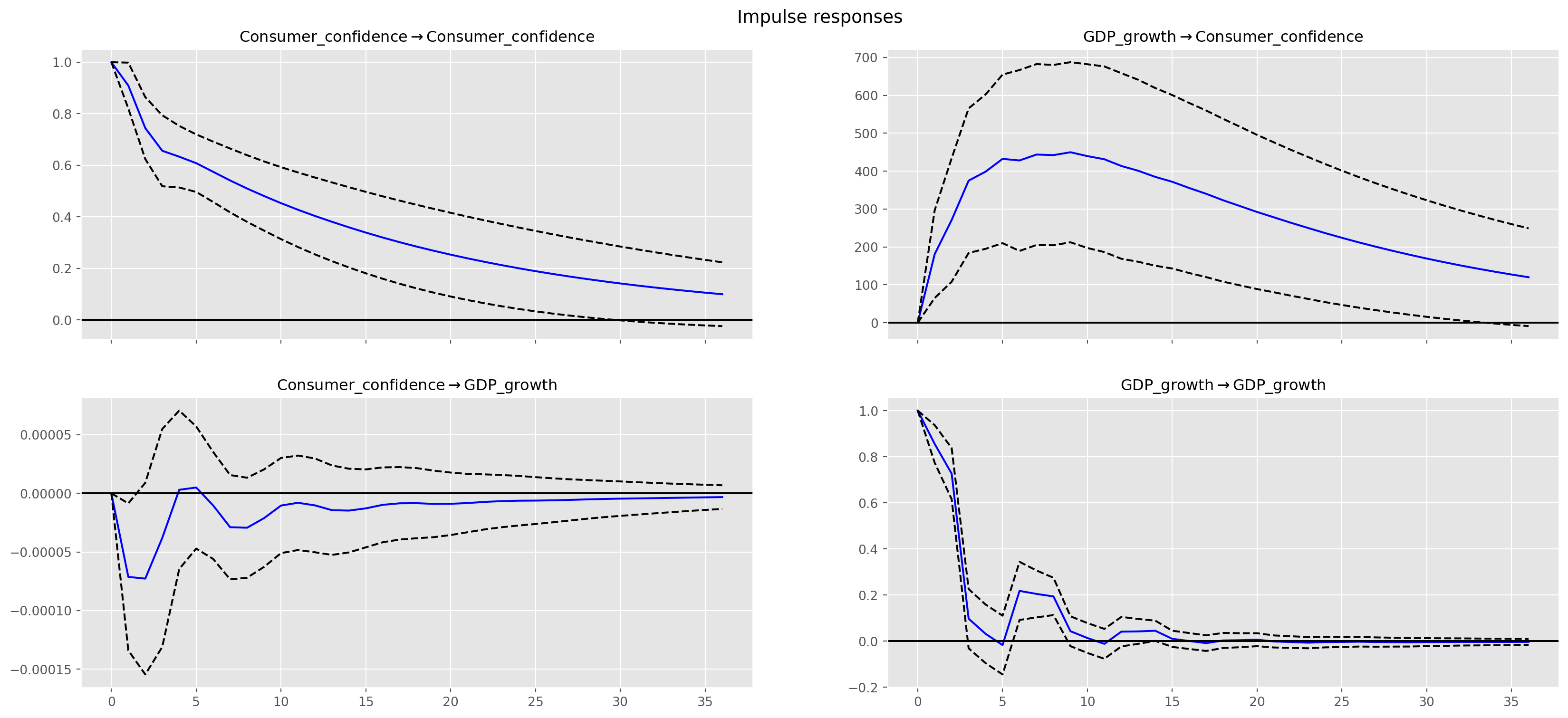

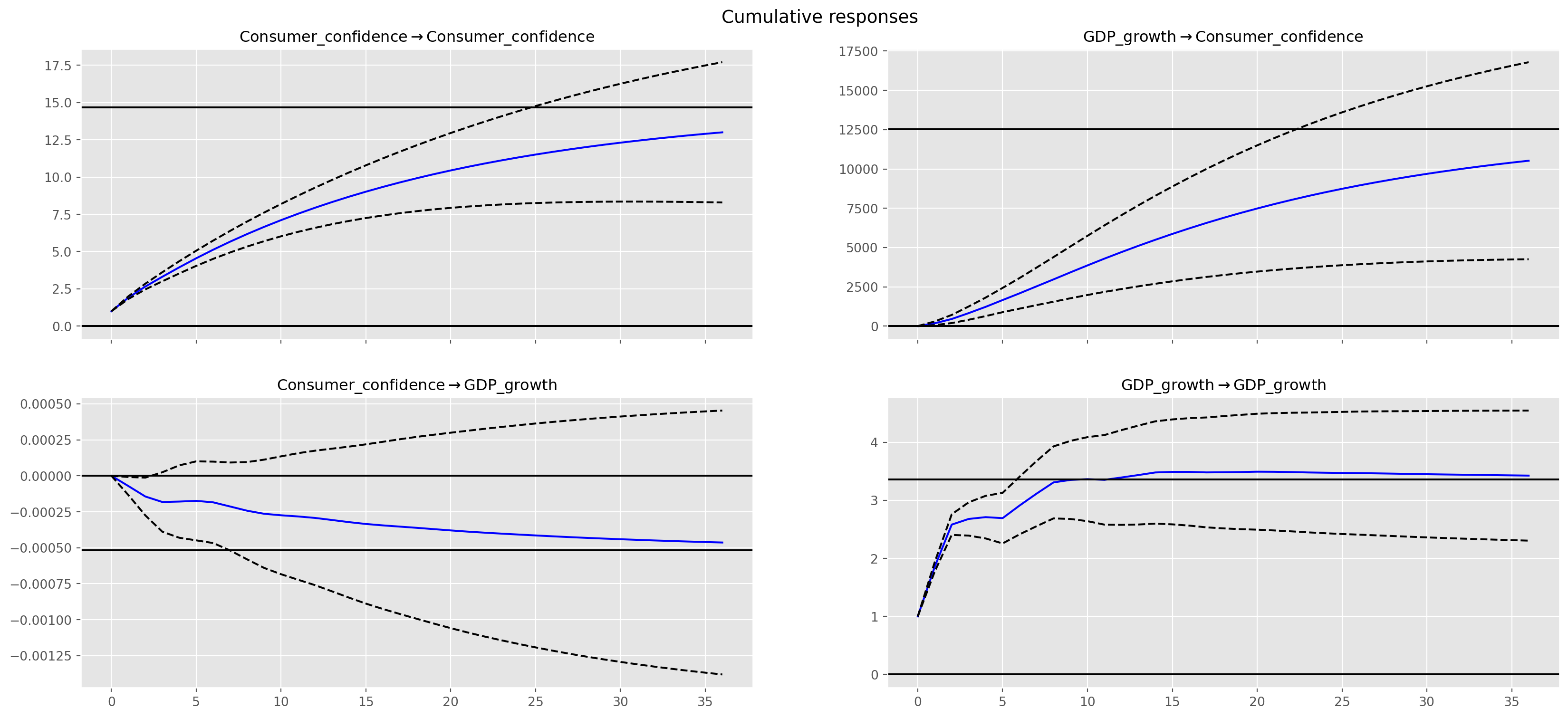

[7.92478640e+01, 6.38997241e-03]])var_irf = var_results.irf(36)As you can see the coefficients are in general difficult to interpret, so the standard practice after estimation is to map out the the Impulse Response Functions (IRF), the IRFs trace out the responses of each variables to shocks in disturbance term, such as \(u_1\) and \(u_2\).

For instance, the \([0, 0]\) position graph shows how one standard deviation shock on consumer confidence can move itself, the \([0, 1]\) position graph shows the traces of GDP growth after give one standard deviation shock of consumer confidence.

Note the unit on the vertical axis is the number of standard deviation.

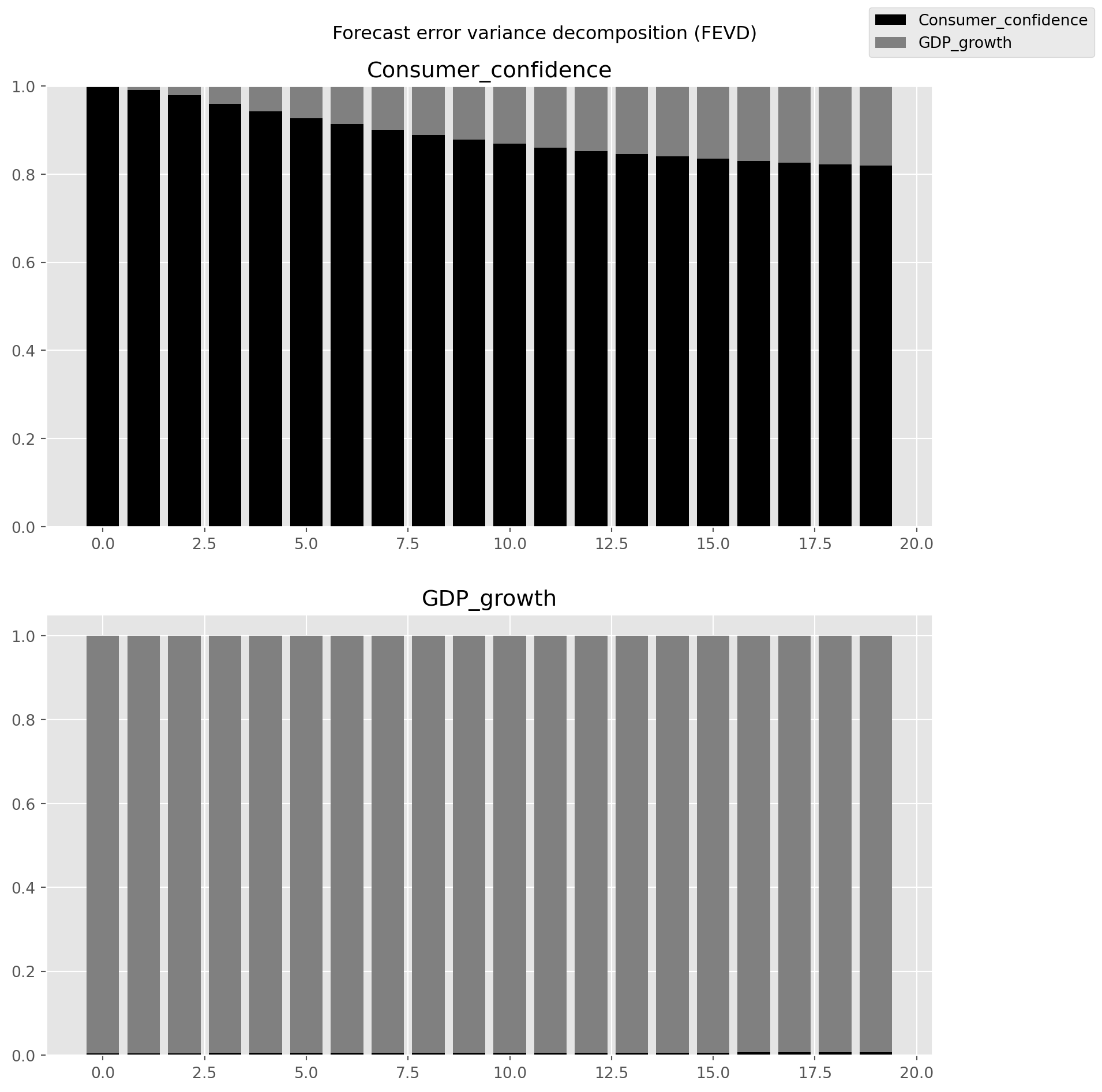

fevd = var_results.fevd(5)

print(fevd.summary())FEVD for Consumer_confidence

Consumer_confidence GDP_growth

0 1.000000 0.000000

1 0.991275 0.008725

2 0.978686 0.021314

3 0.959169 0.040831

4 0.942553 0.057447

FEVD for GDP_growth

Consumer_confidence GDP_growth

0 0.004832 0.995168

1 0.003794 0.996206

2 0.004134 0.995866

3 0.005096 0.994904

4 0.005112 0.994888

NoneARCH and GARCH Models

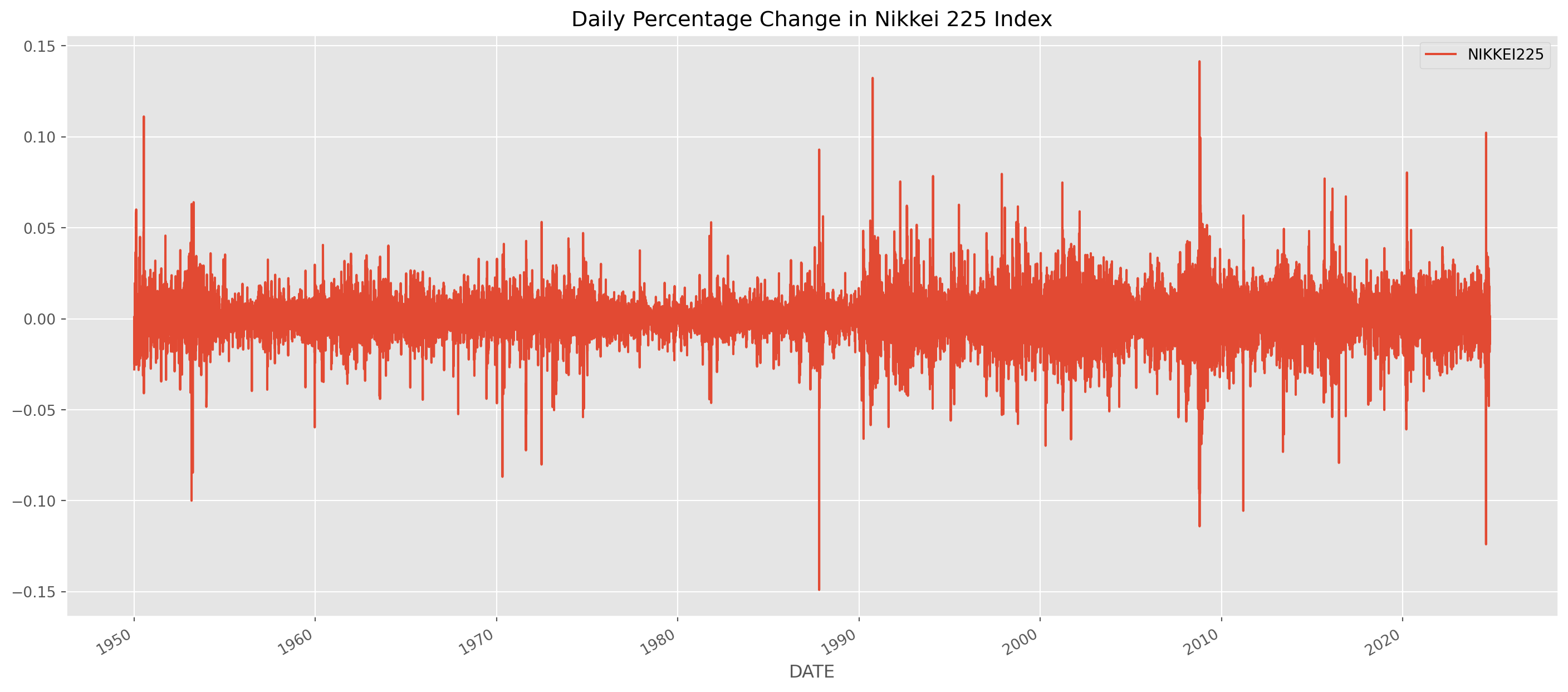

Though we have seen quite many time series, but one important feature of time series we didn’t mention is that volatility tend to cluster, called volatility clustering.

start = dt.datetime(1950, 1, 1)

ni225 = pdr.data.DataReader("NIKKEI225", "fred", start=start)

ni225 = ni225.dropna()ni225.pct_change().plot(

figsize=(18, 8), title="Daily Percentage Change in Nikkei 225 Index"

)

plt.show()There are periods of high volatility and periods of tranquility. Because volatility comes in cluster, the variance of daily percentage change can be forecasted, even though the price itself is difficult to forecast.

The volatility of asset price in the context of finance tells two things: 1. the risk of owning the asset. 2. the value of some financial derivatives depends on the value of underlying assets, such as options.

ARCH Model

The most famous model of volatility clustering is autoregressive conditional heteroskedasticity (ARCH). For instance, an \(\text{ARCH(1)}\) is \[ \sigma_t^2 = \alpha_0 + \alpha_1u_{t-1}^2 \] where \(u\) is the error term of any time series model, such as \(\text{ARMA}\), \(\sigma_t^2\) represents the variance of error term.

The more general \(p\)-order ARCH is \[ \sigma_t^2 = \alpha_0 + \sum_{i=1}^p\alpha_iu_{t-i}^2=\alpha_{0}+\alpha_{1} u_{t-1}^{2}+\alpha_{2} u_{t-2}^{2}+\cdots+\alpha_{p} u_{t-p}^{2} \]

GARCH Model

The generalized ARCH (GARCH) simply extend the ARCH to include lagged \(\sigma\) itself into the model, an \(\text{GARCH(1, 1)}\) is \[ \sigma_t^2 = \alpha_0 + \alpha_1u_{t-1}^2 +\phi_1\sigma_{t-1}^2 \] Similarly, \(\text{GARCH(p, q)}\) \[ \sigma_t^2=\alpha_0 + \sum_{i=1}^p\alpha_iu_{t-i}^2+\sum_{i=1}^p\phi_i\sigma_{t-i}^2=\alpha_{0}+\alpha_{1} u_{t-1}^{2}+\cdots+\alpha_{p} u_{t-p}^{2}+\phi_{1} \sigma_{t-1}^{2}+\cdots+\phi_{q} \sigma_{t-q}^{2} \]